Daily cash counts are made by cashier department supervisors, a crucial task that ensures the financial integrity of businesses. This process involves meticulous counting, reconciliation, and documentation, safeguarding against fraud and maintaining accountability. Understanding the significance and challenges of daily cash counts empowers cashier department supervisors to effectively execute this essential duty.

The importance of daily cash counts extends beyond mere record-keeping. They provide a real-time snapshot of a business’s financial position, enabling timely decision-making and proactive risk management. Moreover, they serve as a deterrent against theft and embezzlement, promoting a culture of honesty and transparency.

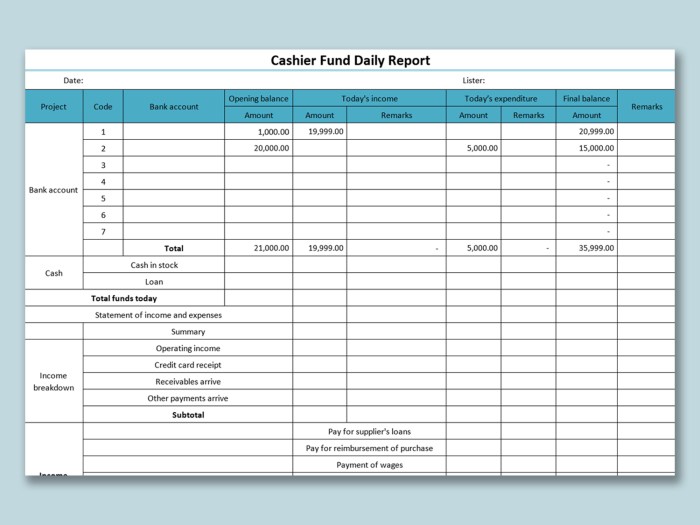

Daily Cash Count Process

Daily cash counts are a crucial aspect of financial management for businesses. Cashier department supervisors play a vital role in ensuring the accuracy and integrity of these counts.

Counting

The daily cash count process typically involves the following steps:

- Cashiers count all cash on hand, including bills, coins, and checks.

- The count is verified by a supervisor.

- Any discrepancies are investigated and corrected.

Reconciling, Daily cash counts are made by cashier department supervisors

After the cash is counted, it is reconciled against the cash register totals and sales records.

Documenting

The results of the daily cash count are documented in a cash count report. This report includes the date, time, amount of cash counted, and any discrepancies found.

Responsibilities of Cashier Department Supervisors: Daily Cash Counts Are Made By Cashier Department Supervisors

Cashier department supervisors are responsible for ensuring the accuracy and integrity of daily cash counts. They must:

- Train and supervise cashiers on cash handling procedures.

- Review and approve daily cash count reports.

- Investigate any discrepancies found during cash counts.

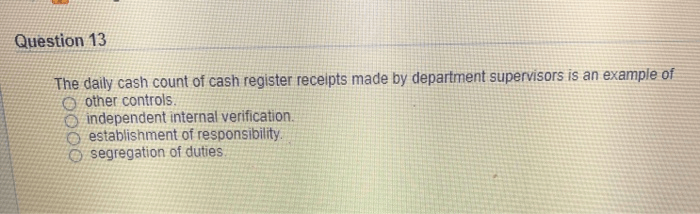

- Implement internal controls to prevent fraud and errors.

Importance of Daily Cash Counts

Daily cash counts are essential for businesses for several reasons:

- Financial Control:They help businesses track their cash flow and ensure that all cash is accounted for.

- Fraud Prevention:Daily cash counts can help detect and prevent fraud by identifying any discrepancies between the actual cash on hand and the records.

- Accountability:Daily cash counts hold cashiers accountable for the cash they handle.

Challenges in Daily Cash Counts

Cashier department supervisors may face several challenges during daily cash counts, including:

- Discrepancies:Discrepancies can occur due to human error, fraud, or theft.

- Errors:Cashiers may make errors when counting cash, which can lead to inaccurate counts.

- Time-Consuming:Daily cash counts can be time-consuming, especially for businesses with high volumes of cash transactions.

Quick FAQs

What are the key responsibilities of cashier department supervisors regarding daily cash counts?

Cashier department supervisors are responsible for overseeing the daily cash count process, ensuring accuracy, preventing discrepancies, and maintaining financial integrity. They establish clear procedures, train staff, and implement internal controls to safeguard the business’s cash assets.

What are the common challenges faced by cashier department supervisors during daily cash counts?

Common challenges include human error, discrepancies between cash on hand and sales records, and potential fraud or theft. Cashier department supervisors must be vigilant in addressing these challenges through effective training, supervision, and internal controls.